As an independent insurance adjuster, staying informed and prepared is essential, especially during hurricane season. With the potential for widespread damage and significant insurance claims, being well-versed in the nuances of hurricane season can make all the difference in effectively navigating the aftermath. Here are five crucial facts about hurricane season that every independent adjuster should know:

1. Timing and Duration Vary

Hurricane season in the Atlantic typically runs from June 1st to November 30th, peaking from mid-August to late October. However, it’s essential to note that hurricanes can form outside of this timeframe, and their duration can vary. As an independent adjuster, staying vigilant throughout the entire season is key, as storms can develop rapidly and impact areas with little warning.

2. Understanding Storm Categories

Hurricanes are classified based on their wind speed and potential for damage using the Saffir-Simpson Hurricane Wind Scale. Understanding the different categories, ranging from Category 1 (74-95 mph) to Category 5 (157+ mph), is crucial for assessing the severity of damage and estimating claims. Independent adjusters must be prepared to handle claims associated with various storm intensities.

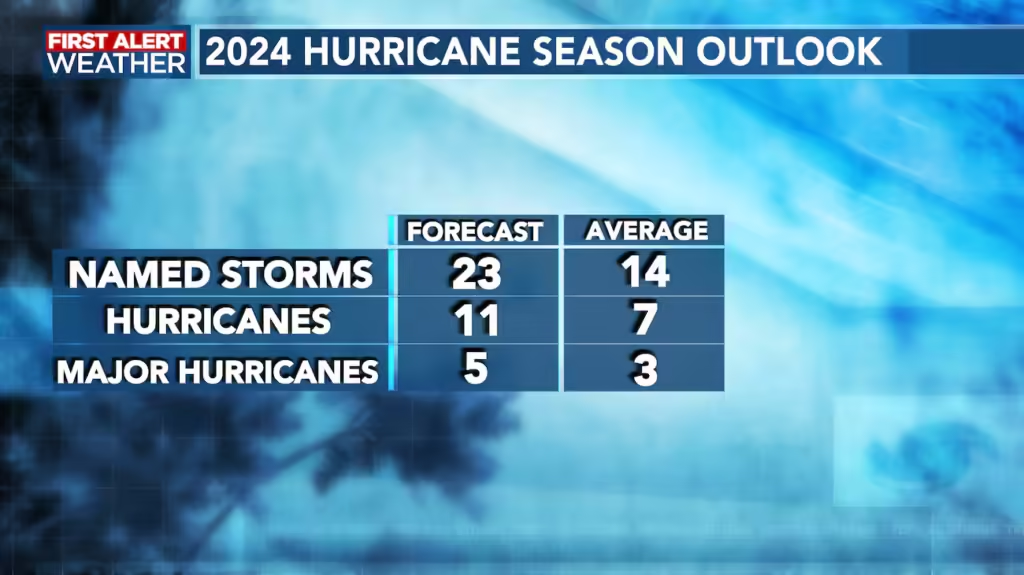

3. Preparing for High-Volume Claims

Hurricanes often result in a surge of insurance claims, overwhelming adjusters and insurers alike. As an independent adjuster, it’s essential to be prepared for high-volume claims and potentially extended deployments to affected areas. Developing efficient workflows, leveraging technology, and collaborating with other adjusters can help streamline the claims process during peak periods.

4. Safety First

Safety should always be the top priority for independent adjusters when responding to hurricane-related claims. Before deploying to impacted areas, ensure that you have the necessary personal protective equipment (PPE) and are familiar with safety protocols. Be mindful of potential hazards, such as downed power lines, unstable structures, and floodwaters, and prioritize your well-being at all times.

5. Evolving Regulatory Landscape

In the wake of significant hurricanes, regulatory requirements and procedures may evolve to address emerging challenges and streamline the claims process. Independent adjusters must stay informed about any changes to regulations, licensing requirements, or industry standards that may impact their work. Continuous education and professional development are essential for staying ahead of the curve in this dynamic environment.

Conclusion

Hurricane season presents unique challenges and opportunities for independent insurance adjusters. By understanding the timing and duration of the season, familiarizing yourself with storm categories, preparing for high-volume claims, prioritizing safety, and staying abreast of regulatory changes, you can effectively navigate the complexities of hurricane-related claims. Armed with knowledge and preparedness, independent adjusters play a vital role in helping policyholders recover from the devastating effects of hurricanes and rebuild their lives with confidence.