Introduction

Hurricanes are among the most powerful and destructive forces of nature, capable of causing widespread devastation to coastal communities and inland areas alike. As insurance professionals, understanding the regions most prone to hurricane damage is crucial for effectively assessing and managing claims. In this blog post, we’ll embark on a journey to explore the top five states in the United States for hurricane damage, shedding light on the unique challenges faced by residents and insurance adjusters alike.

Florida: The Sunshine State

With its extensive coastline and warm, tropical climate, Florida tops the list as the most hurricane-prone state in the US. From the Florida Keys to the Panhandle, the Sunshine State experiences a high frequency of hurricanes and tropical storms each year, making it a hotbed for insurance claims related to wind damage, storm surge, and flooding.For insurance professionals operating in Florida, navigating the complexities of hurricane claims requires specialized expertise and a thorough understanding of state regulations. With its dense population and diverse coastal ecosystems, Florida presents both challenges and opportunities for adjusters seeking to assist policyholders in the aftermath of a hurricane.

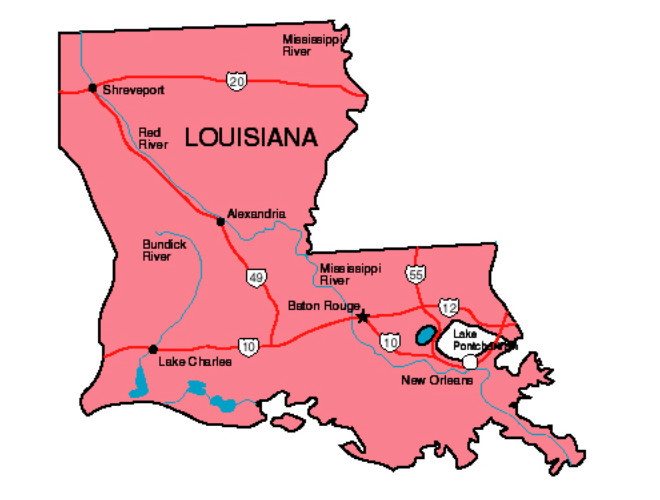

Louisiana: The Pelican State

Situated along the Gulf Coast, Louisiana is no stranger to the destructive power of hurricanes. Cities like New Orleans, Baton Rouge, and Lake Charles have endured devastating storms throughout history, leaving behind a legacy of destruction and resilience in their wake.For insurance adjusters operating in Louisiana, the aftermath of a hurricane often involves assessing damage to homes, businesses, and infrastructure, as well as navigating the complexities of flood insurance claims. With its unique cultural heritage and geographical challenges, Louisiana offers a dynamic environment for adjusters seeking to make a difference in the lives of policyholders affected by hurricanes.

Texas: The Lone Star State

While not traditionally associated with hurricanes, Texas is no stranger to the impact of powerful storms. Coastal cities like Houston, Corpus Christi, and Galveston are vulnerable to storm surge and flooding during hurricane season, posing significant challenges for residents and insurance professionals alike.In addition to wind and water damage, Texas also faces the threat of inland flooding from slow-moving tropical systems, as evidenced by events like Hurricane Harvey in 2017. For adjusters operating in Texas, responding to hurricane-related claims requires adaptability and a commitment to serving communities in their time of need.

North Carolina: The Tar Heel State

Positioned along the Atlantic Coast, North Carolina is susceptible to hurricanes and tropical storms that track along the eastern seaboard. Cities like Wilmington, Outer Banks, and Morehead City are frequent targets for hurricanes, experiencing high winds, heavy rainfall, and storm surge during the peak of hurricane season.For insurance professionals in North Carolina, responding to hurricane damage often involves assessing damage to coastal properties, as well as inland areas prone to flooding and wind-related destruction. With its rich maritime history and scenic landscapes, North Carolina presents both challenges and opportunities for adjusters seeking to assist policyholders impacted by hurricanes.

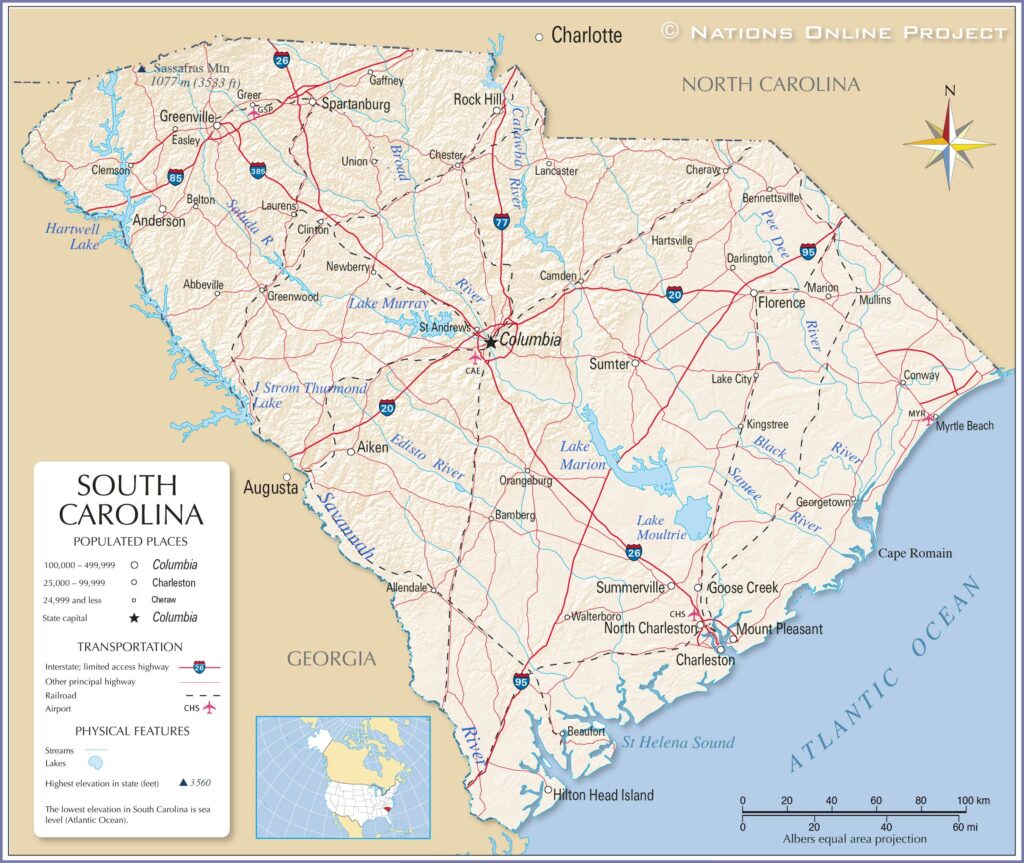

South Carolina: The Palmetto State

Like its neighbor to the north, South Carolina faces the threat of hurricanes and tropical storms that sweep across the Atlantic Ocean. Coastal communities such as Charleston, Myrtle Beach, and Hilton Head Island are at risk of experiencing significant damage from high winds, storm surge, and flooding.For insurance adjusters operating in South Carolina, responding to hurricane-related claims requires a deep understanding of the state’s coastal geography and vulnerability to tropical weather systems. With its bustling tourism industry and rich cultural heritage, South Carolina offers a diverse array of challenges and opportunities for adjusters seeking to assist policyholders affected by hurricanes.

Conclusion

Hurricanes pose a significant threat to coastal communities and inland areas across the United States, leaving behind a trail of destruction that can be costly to repair. As insurance professionals, understanding the top states for hurricane damage, including Florida, Louisiana, Texas, North Carolina, and South Carolina, is essential for effectively assisting policyholders in their time of need. By leveraging specialized expertise and a commitment to service, adjusters play a vital role in helping communities recover from the impact of hurricanes, restoring hope and resilience in the face of adversity.